You must also record employee overtime, employment training, and expenses. DCAA says employers must document workers and the amount of time they work on contract work.

QUICKBOOKS INVOICING PROFESSIONAL

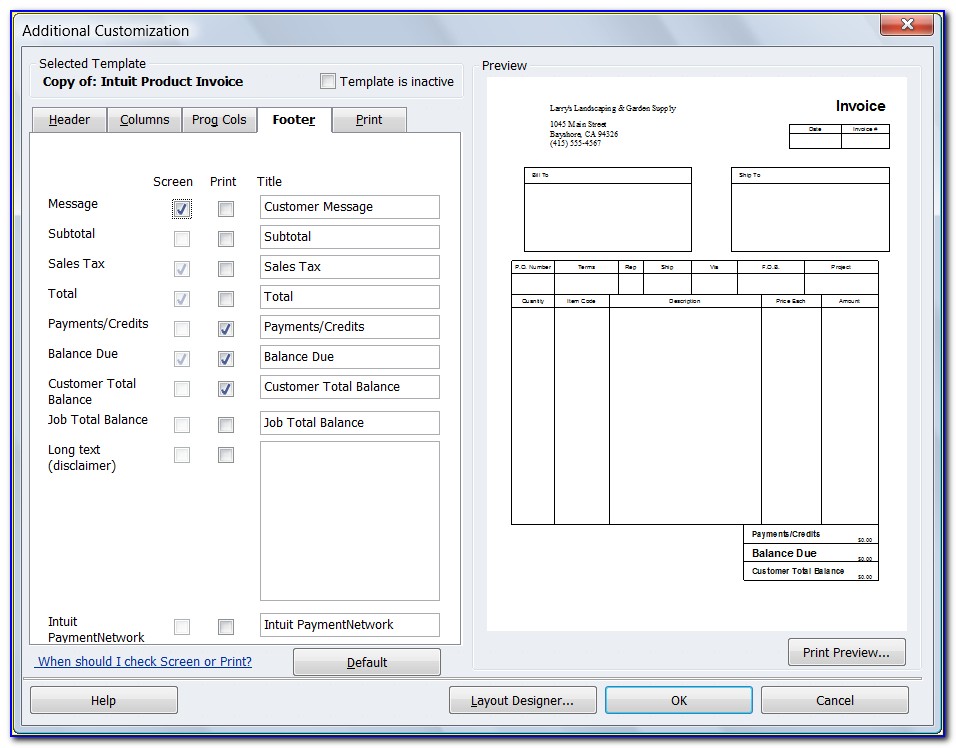

If your professional services firm works with government agencies, you know how important it is to have a timesheet configured to meet Defense Contract Audit Agency (DCAA) requirements. For custom requirements, developers can connect BigTime via the QuickBooks integration API. In addition to easy-to-use invoicing, time tracking and project management software, the QuickBooks Desktop app includes analytics and reporting dashboards, expense tracking and DCAA time tracking complying with government billing requirements.īigTime is one of the best invoicing apps that integrate with QuickBooks Desktop. The integrated platform provides several features sure to make professional services firms happy. You can find BigTime on the QuickBooks Marketplace for Desktop applications. Apps That Integrate With QuickBooks DesktopīigTime is an invoicing solution with QuickBooks integration with desktop and online versions.

It also integrates with other QuickBooks apps.

BigTime is a SaaS product that works with both QuickBooks’ Online and Desktop versions. BigTime is one of the best invoicing apps that work with QuickBooks and helps professional service teams manage their client workloads, invoicing and online payments without missing a beat. BigTime is a company based in Chicago with over 2,000 users and manages billions of dollars in client invoicing and payments.

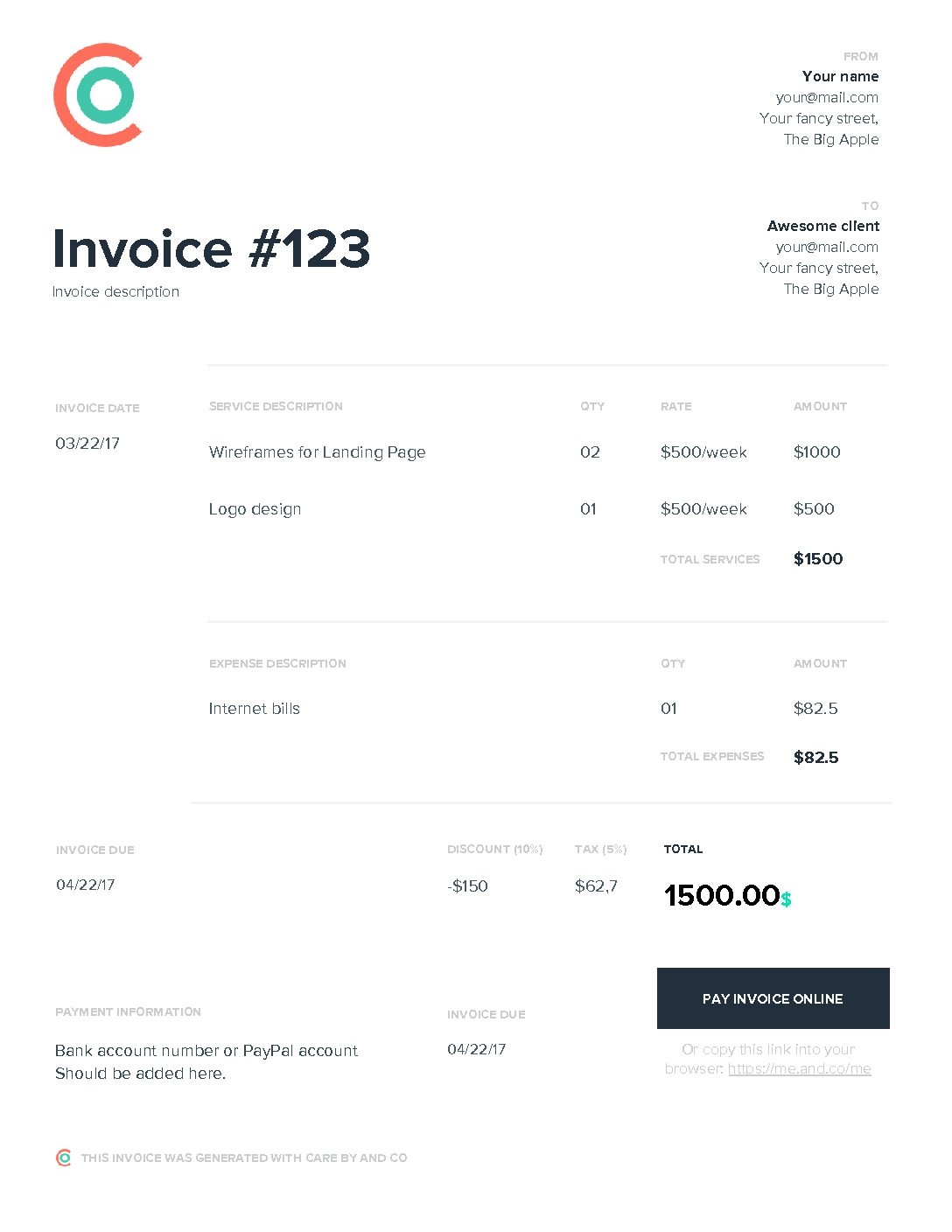

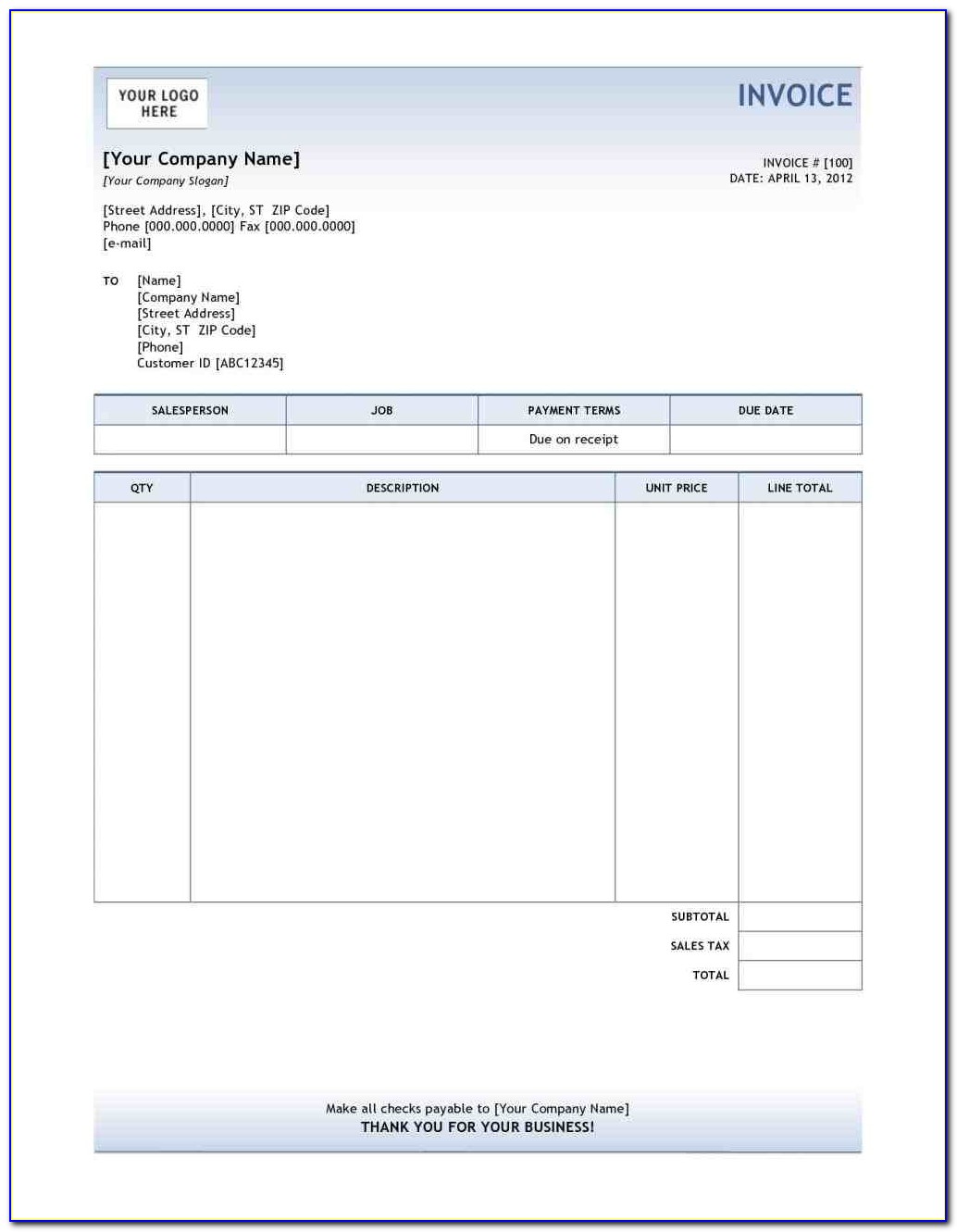

QUICKBOOKS INVOICING SOFTWARE

Integrating third-party apps to QuickBooks saves accounting staff time, improves transparency for account teams and improves the customer experience by providing self-service portals to pay bills and obtain project updates.Ī better solution is to use invoicing software that integrates with QuickBooks, CRM software and other customer-facing applications. Meanwhile, the account service team doesn’t have insights into invoicing and must bother the accounting team to check up on payment status to respond to client inquiries. Managing all of these disparate apps and processes adds up to administrative costs for accounting or bookkeepers to manage. Once the invoices are sent, customers use QuickBooks payments, credit cards or ACH services through online payment processors or banks. Many firms use multiple apps to manage these processes and then manually re-enter data into QuickBooks to generate invoices. Tracking employee time on customer projects needs to roll up into invoicing every month. Account managers often need to produce estimates based on internal human resources. In a professional services firm, invoicing is an integral part of customer service. QuickBooks is a great bookkeeping app, but if your account management team needs to track time, manage projects and do invoicing, then providing them with direct access to QuickBooks isn’t practical. Many professional service firms rely on QuickBooks as their accounting and invoicing software.

0 kommentar(er)

0 kommentar(er)